Find solutions

Customer login

Web versionBusiness login

Log in to manage your orders, payout reports, store statistics, and general settings.

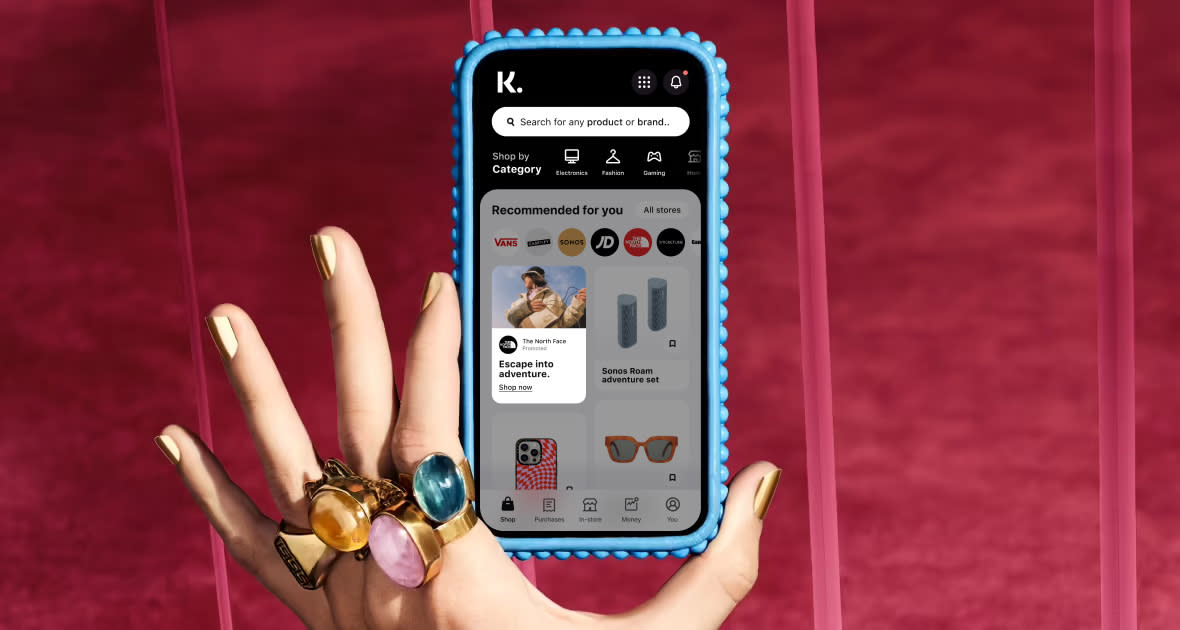

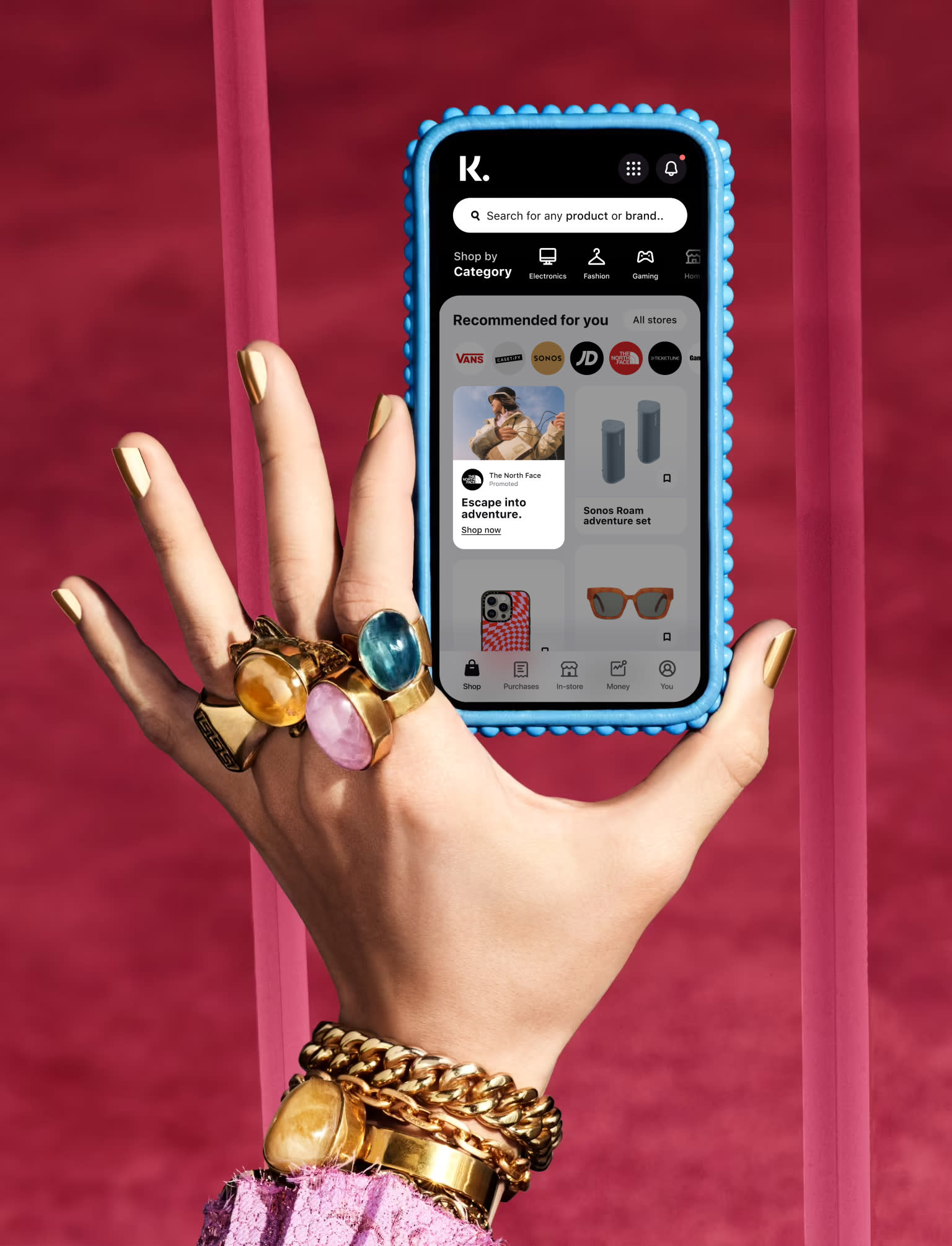

Introducing smarter marketing.

Achieve efficient, profitable growth with Klarna’s performance-driven marketing solutions. Brands using our solutions benefit from:

high-intent shoppers.

up to 70% increase in revenue.

up to 25% increase in return on ad spend.

Engage new customers at scale.

Our vast ecosystem reaches 37 million engaged shoppers primed to purchase. Drive new customers and efficient growth for your brand by partnering with Klarna, a top-tier publisher focusing on the complete consumer journey from discovery to conversion.

Browser Extension

Convert incentive driven shoppers.

Drive conversions by providing hyper-relevant, targeted content to incentive-driven consumers.

Closed Loop Reporting

Optimize campaigns for efficiency.

Increased visibility into campaign performance improves your marketing spend. Be more efficient and get higher ROI with in-depth insights.

Klarna is trusted by the world's leading brands.

Grow your business with marketing that performs.

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Monthly financing through Klarna and One-time card bi-weekly payments with a service fee to shop anywhere in the Klarna App issued by WebBank. Other CA resident loans at select merchants made or arranged pursuant to a California Financing Law license. Copyright © 2005-2024 Klarna Inc. NMLS #1353190, 800 N. High Street Columbus, OH 43215. VT Consumers: For WebBank Loan Products (One-Time Cards, Financing, Klarna Card): THIS IS A LOAN SOLICITATION ONLY. KLARNA INC. IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.